The restaurant industry thrives on satisfied customers and happy staff. But beneath the surface of a bustling dining room lies a hidden pressure point: tip management. Manual calculations are a recipe for errors, leading to frustrated employees and potential legal battles. In today’s digital age, with complex regulations and evolving payment methods, ensuring legal compliance in tip management has become more critical than ever.

Let’s face it, traditional tip management is a time-consuming headache. Servers spend precious minutes tallying numbers, managers juggle complex calculations, and spreadsheets become a confusing mess. This leaves plenty of room for errors, and in the fast-paced environment of restaurants, mistakes happen.

A 2023 National Restaurant Association report highlights that 80% of restaurant operators face significant challenges managing labor costs, suggesting complex regulations are a major concern. This isn’t unfounded anxiety. Here’s why manual tip management is a legal mess:

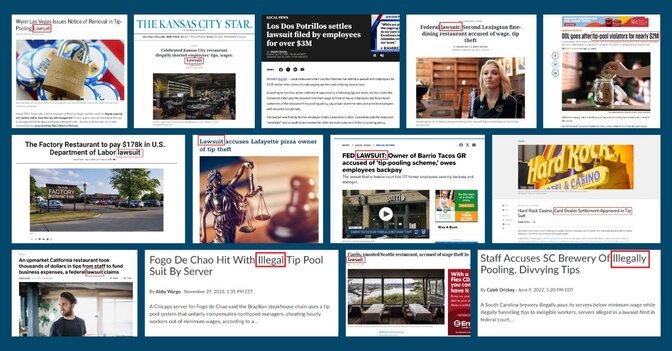

Millions in fines, disgruntled employees, and costly lawsuits – these are just some of the consequences restaurants face with manual tip management. For example, Seattle’s Skillet diner chain will pay over $318,000 to employees and a fine to the city for allegedly misallocating service fee funds and violating labor laws. In another instance, former employees of Barbara Lynch’s restaurants filed a class-action lawsuit alleging tips were not distributed to staff when the eateries reopened during the pandemic, violating Massachusetts law. Similarly, a former server is suing Jeff Ruby’s restaurants alleging they skimmed the server tip pool to pay non-tipped workers and potentially underpaid all tipped employees. These cases exemplify the real-world consequences restaurants face when tip management practices fall short of legal requirements.

TipHaus is the industry expert on tip management, dedicated exclusively to helping restaurants, bars, and hospitality venues streamline their tipping processes. Unlike one-size-fits-all solutions, TipHaus goes beyond surface-level functionality to tailor every restaurant's tip structure to its unique needs. By focusing solely on tips, we deliver unmatched expertise and customization, ensuring our clients stay ahead in an ever-evolving industry.

The rise of digital payments presents a double-edged sword for restaurants. While it streamlines transactions for customers, it adds a layer of complexity to tip management and legal compliance.

State-specific regulations and evolving digital payment structures create confusion. Understanding these nuances is crucial to avoid legal pitfalls. As mentioned before, some states allow mandatory tip pools, while others don’t. Failing to account for credit card processing fees when calculating digital tips can shortchange your staff, leaving them vulnerable and potentially sparking legal disputes.

Manual calculations are prone to errors, and the digital age introduces new opportunities for mistakes. Employees might allege they weren’t included in the tip pool, or that credit card processing fees were not factored in correctly. These disputes can escalate into costly lawsuits, damaging your staff morale and restaurant reputation.

Embracing automation in tip management offers a powerful solution for mitigating legal risk. Here’s how:

Automated tip calculations eliminate human error, ensuring accurate distributions and minimizing the potential for disputes. A 2021 study by the ADP Research Institute found that restaurants implementing automated tip solutions experienced a 75% reduction in tip-related payroll errors.

Automated systems can be programmed to factor in state-specific regulations and minimum wage requirements, streamlining adherence to legal guidelines.

Automated systems often provide detailed reports on tip calculations and distributions, fostering transparency with staff and simplifying record-keeping for audits.

TipHaus Tip: Regularly review and update your tip pooling or sharing policies to reflect changes in labor laws and digital payment trends. Clear, transparent communication with your team about these policies not only boosts trust but also ensures everyone understands how tips are managed, minimizing disputes before they arise.

TipHaus, the industry leader in automated tip solutions, simplifies compliance and reduces legal risk for restaurants nationwide. Here’s how TipHaus empowers you:

By automating calculations, we eliminate human error and ensure fair, consistent tip distribution for your staff, regardless of whether it’s tips OR service charges. This fosters trust and a positive work environment, keeping your employees happy and engaged. Additionally, TipHaus streamlines operations by automating workflows and freeing up valuable management time. This allows you to focus on what truly matters – delivering exceptional service and creating a thriving restaurant atmosphere. Finally, TipHaus offers peace of mind by guaranteeing compliance with all tip pooling, tip sharing, minimum wage regulations, and service charge distribution.

TipHaus Ensures:

With TipHaus, you can create a happier, more efficient restaurant environment, all while protecting your business from legal complications. Let us handle the legal complexities so you can focus on running your restaurant with confidence.

Discover how TipHaus can transform your restaurant’s tip distribution. Click here to explore the platform.